Secure Revenue, Brand, and Customers

Eliminate financial loss and reputational damage by proactively blocking account takeover (ATO), payment fraud, and brand impersonation across web, mobile, and email channels.

Start here

Proactive Defense Against Financial Loss

Traditional fraud solutions operate reactively, waiting for fraudulent transactions or chargebacks to occur. Hunto AI shifts the defense to the source of the attack. By integrating Threat Intelligence and Digital Risk Protection (DRP), we detect the adversary’s infrastructure—the fake login pages, fraudulent apps, and dark web activity; before the financial attack is launched. We stop Account Takeover (ATO), payment fraud, and sophisticated brand impersonation to protect both your revenue stream and your customer trust across all digital touchpoints.

Fraud Group Disruption

Channels Protected

Detection Accuracy

Global Analyst Network

Solving Cyber Threat Intelligence Challenges

See how Hunto AI transforms raw data into Strategic, Operational, and Tactical intelligence for proactive defense.

Problem

Fraud schemes rapidly shift across channels (web, social, mobile) and often originate in the Dark Web, bypassing single-channel or reactive fraud detection tools.

Solution

Continuously scan and monitor all digital channels, including the Dark Web and mobile app stores, to identify fraudulent assets, phishing kits, and compromised data in real-time.

- Detects Account Takeover (ATO) attempts via exposed credentials.

- Monitors Ad Fraud and abuse targeting marketing campaigns.

- Tracks fraudulent storefronts and e-commerce impersonation.

Problem

Security teams often block individual fraudulent assets without understanding the underlying criminal network, allowing fraud groups to quickly re-establish and continue their attacks.

Solution

Automatically correlate discovered fraudulent infrastructure (domains, IPs, tools) with Threat Intelligence to attribute attacks to specific fraud groups, mapping their tactics and procedures.

- Correlate Indicators

- Identify Attacker TTPs

- Enrich Threat Intelligence

Problem

Manual takedown processes are too slow, allowing fraudulent sites and phishing pages to operate for critical hours, maximizing financial loss and customer exposure.

Solution

Execute one-click, AI-driven takedowns to rapidly neutralize phishing sites, fraudulent social media accounts, and fake mobile apps, disrupting fraud groups within 24 hours.

- Minimize Dwell Time

- Disrupt Repeat Attacks

- Global Takedown Network

Problem

Technical fraud findings lack the high-level context required by executives and compliance officers to make strategic risk management decisions and report accurately.

Solution

Provide detailed forensics and reporting on all fraud attempts, giving executives and security teams the contextualized analysis needed for compliance, policy refinement, and strategic investment.

- Executive-Ready Reports

- MITRE ATT&CK Alignment

- Data Feeds for Compliance

Fraud Intelligence Amplified

Our Fraud Protection is powered by the platform’s core intelligence, using Dark Web findings to validate threats and link fraudulent infrastructure directly to External Attack Surface Management for comprehensive defense.

Fraud Infrastructure Linking

Discovered fraudulent infrastructure (fake login pages, spoofed domains) is analyzed and cross-referenced with ASM to ensure no critical, uninventoried asset is linking back to your environment, preventing supply chain attacks.

Warning

Real-Time Credential Monitoring

Account Takeover (ATO) risk is mitigated by continuously monitoring Dark Web forums and breach sites for compromised credentials. This data is instantly fed to Human Risk to force mandatory password resets for high-risk users.

BEC & Spoofing Validation

Fraudulent emails and domain spoofing attempts detected by Business Email Protection (BEP) are automatically flagged in the Fraud module. This validates the source of BEC attempts, enabling better attribution and financial loss prevention.

Protecting Revenue and Trust

Reduced Fraud-Related Financial Loss

Minimize losses from fraudulent transactions, chargebacks, and account takeover (ATO) by proactively disrupting schemes before they reach your customers.

Rapid Fraud Group Disruption

Achieve takedown and disruption of entire fraudulent campaigns (sites, social accounts, apps) often within 24 hours to prevent repeat attacks.

Maximized Customer Trust

Protect your customers from being targeted by phishing and impersonation schemes, directly reducing help desk tickets and enhancing brand loyalty.

What “Great” Looks Like (Benchmarked Against Leaders)

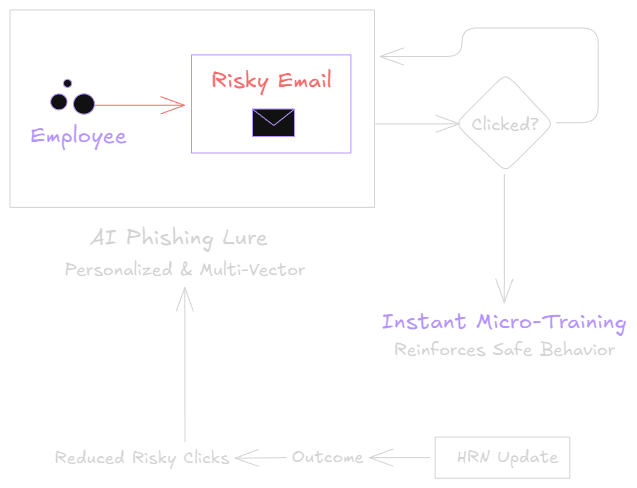

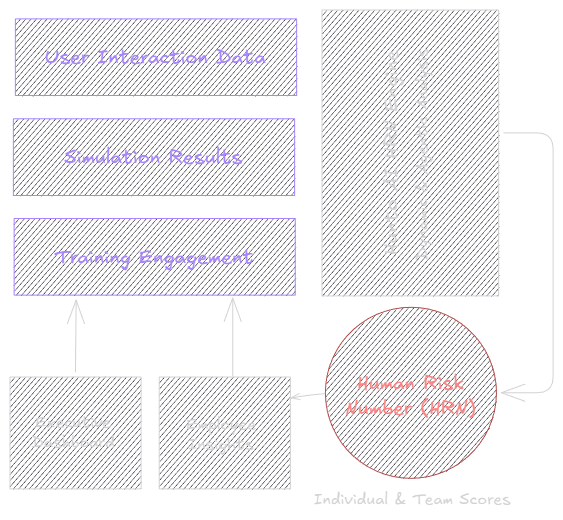

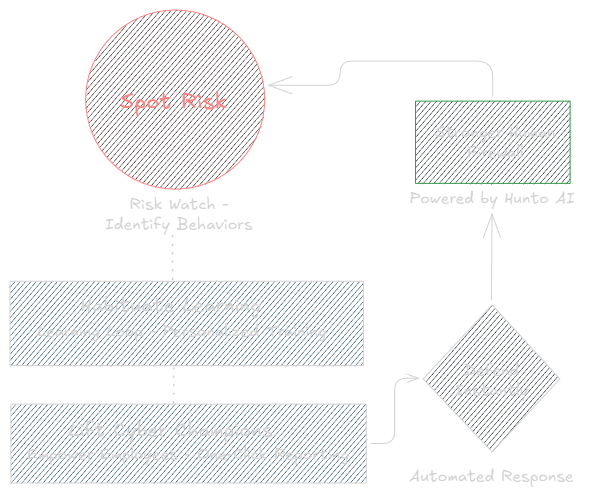

See how Hunto AI stacks up against top platforms with personalized content, automated campaigns, and real-time risk scoring.

24-Hour Fraud Group Disruption

Automatically map and neutralize the entire criminal infrastructure (sites, social accounts, apps) behind a campaign, preventing the escalation and repetition of attacks within a single day.

Comprehensive Channel Coverage

Eliminate blind spots by monitoring all vectors: Web, Social Media, Mobile App Stores, Ad networks, and the Dark Web, ensuring fraud cannot simply shift channels.

Intelligence-Driven Attribution

Correlate fraudulent assets with Threat Intelligence to link campaigns to specific threat actors and TTPs, moving beyond simple blocking to strategic defense.

Common Questions

Frequently asked questions

This section answers common questions to help you understand how Hunto AI protects your digital assets and brand against external cyber threats.

Hunto AI Fraud Protection is a comprehensive AI-powered solution designed to detect, prevent, and mitigate fraud across all digital channels in real time. It uses machine learning, behavioral analytics, and patented anti-bot technology to monitor user behavior, analyze transaction patterns, and identify anomalies. This proactive approach minimizes fraud losses while maintaining a seamless user experience by reducing false positives and automation of fraud detection processes.

Hunto AI Fraud Protection is delivered as a cloud-native SaaS solution that enables rapid deployment. Integration with existing security infrastructure—including SIEM, SOAR, and fraud management platforms—is streamlined through APIs and standardized feeds like STIX and TAXII. Most organizations can activate core functionalities and connect critical channels within days, with ongoing tuning and support to tailor the system for unique operational environments.

The platform combats a wide range of sophisticated fraud types, including account takeover, web scraping, brute force attacks, SIM swaps, social engineering, payment fraud, and bot-driven abuse. Its AI models continuously evolve to detect new threats by analyzing behavioral patterns and deep correlations across channels, devices, and user activity—keeping pace with emerging fraud tactics to protect financial transactions and sensitive user data.

By leveraging advanced behavioral analysis and fingerprinting, Hunto AI Fraud Protection differentiates between legitimate customer behaviors and fraudulent actions with high precision. This allows organizations to implement frictionless authentication processes that minimize unnecessary user verification steps. The platform’s explainable AI and risk scoring help reduce false positives, which in turn enhances customer satisfaction and reduces operational costs related to transaction friction.

Hunto AI offers dedicated customer support including expert anti-fraud analysts, digital forensics teams, and continuous monitoring to refine detection rules and adaptive machine learning models. Clients benefit from customized dashboards, detailed reports, and actionable intelligence to address evolving threats. Additionally, Hunto AI collaborates closely with clients for industry-specific needs, ensuring continuous optimization and measurable improvements in fraud prevention performance.